Vital Aspects Before Creating a Financial Offshore Investment Account

Vital Aspects Before Creating a Financial Offshore Investment Account

Blog Article

Why You Ought To Consider Financial Offshore Options for Property Defense

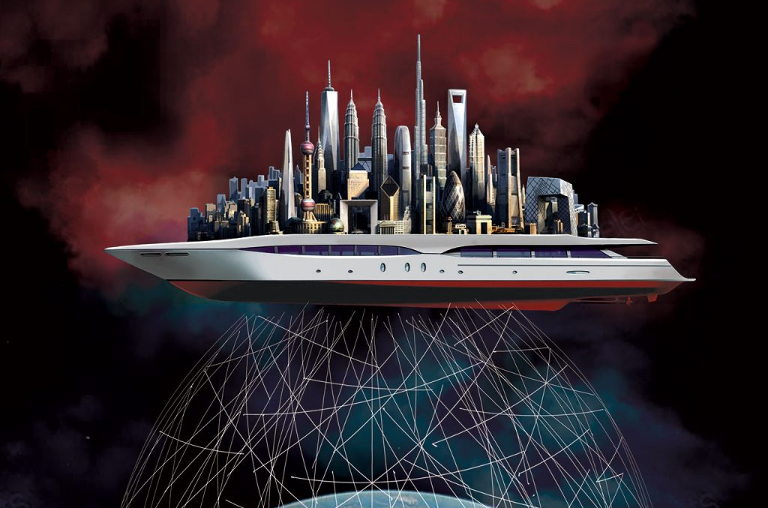

In an age noted by economic changes and expanding litigation hazards, people seeking durable property security might discover solace in offshore monetary alternatives (financial offshore). These choices not only provide boosted privacy and potentially reduced tax obligation rates yet also develop a tactical barrier versus residential monetary instability. By exploring diverse financial investment landscapes in politically and economically steady countries, one can attain an extra protected monetary ground. This strategy motivates a reconsideration of asset administration techniques, advising a more detailed take a look at how offshore strategies might serve lasting economic goals.

Understanding the Basics of Offshore Banking and Investing

While numerous people seek to improve their financial safety and personal privacy, offshore financial and investing arise as feasible techniques worth considering. Offshore financial refers to handling monetary possessions in establishments located outside one's home country, usually in territories recognized for desirable regulative environments.

These financial techniques are especially attractive for those intending to safeguard assets from financial instability in their home country or to get to investment products not available in your area. Offshore accounts could likewise provide more powerful property security against legal judgments, possibly protecting wealth better. Nonetheless, it's crucial to recognize that while overseas banking can provide substantial benefits, it also entails complicated considerations such as recognizing foreign financial systems and navigating currency exchange rate variants.

Legal Factors To Consider and Compliance in Offshore Financial Activities

Key conformity problems include sticking to the Foreign Account Tax Compliance Act (FATCA) in the United States, which needs coverage of foreign financial assets, and the Common Reporting Standard (CRS) established by the OECD, which entails information sharing in between nations to fight tax obligation evasion. In addition, people have to know anti-money laundering (AML) regulations and know-your-customer (KYC) laws, which are rigid in lots of territories to protect against unlawful activities.

Recognizing these legal ins and Continued outs is vital for keeping the authenticity and safety of offshore financial involvements. Appropriate lawful guidance is necessary to guarantee complete compliance and to optimize the advantages of offshore monetary strategies.

Contrasting Domestic and Offshore Financial Opportunities

Comprehending the lawful complexities of offshore economic activities helps investors identify the distinctions in between offshore and domestic economic possibilities. Locally, investors are commonly more aware of the regulative environment, which can supply a sense of security and convenience of access. For example, U.S. financial institutions and investment company run under well-established legal frameworks, supplying clear standards on tax and capitalist security.

Offshore monetary opportunities, nonetheless, typically provide greater personal privacy and potentially lower tax obligation rates, look these up which can be useful for asset protection and development. Territories like the Cayman Islands or Luxembourg are prominent due to their positive financial plans and discernment. These advantages come with obstacles, including boosted analysis from worldwide regulative bodies and the complexity of handling financial investments throughout different legal systems.

Capitalists have to evaluate these variables meticulously. The selection in between offshore and domestic alternatives must straighten with their economic goals, threat tolerance, and the legal landscape of the corresponding territories.

Actions to Start Your Offshore Financial Trip

Starting view publisher site an offshore monetary journey needs cautious preparation and adherence to lawful guidelines. People should first carry out comprehensive research to recognize ideal nations that offer robust economic solutions and beneficial legal frameworks for possession defense. This includes evaluating the political stability, economic environment, and the particular legislations connected to overseas monetary tasks in potential countries.

The next step is to speak with a financial expert or legal expert who concentrates on global money and taxes. These experts can supply tailored guidance, ensuring compliance with both home nation and worldwide legislations, which is critical for staying clear of legal repercussions.

Once an appropriate jurisdiction is picked, individuals need to proceed with establishing the required economic structures. This generally consists of opening up savings account and creating lawful entities like trust funds or firms, depending upon the individual's specific financial goals and requirements. Each action should be carefully recorded to keep openness and help with recurring conformity with regulative needs.

Verdict

In a period noted by financial fluctuations and growing litigation threats, people seeking robust possession defense might discover solace in overseas economic alternatives. financial offshore.Engaging in overseas economic activities demands a detailed understanding of legal frameworks and governing conformity throughout different territories.Understanding the lawful complexities of offshore economic activities assists investors identify the distinctions between overseas and domestic monetary chances.Offshore economic possibilities, however, usually provide higher privacy and possibly reduced tax obligation rates, which can be beneficial for asset defense and growth.Embarking on an overseas monetary journey requires cautious preparation and adherence to lawful guidelines

Report this page